What is a REIT?

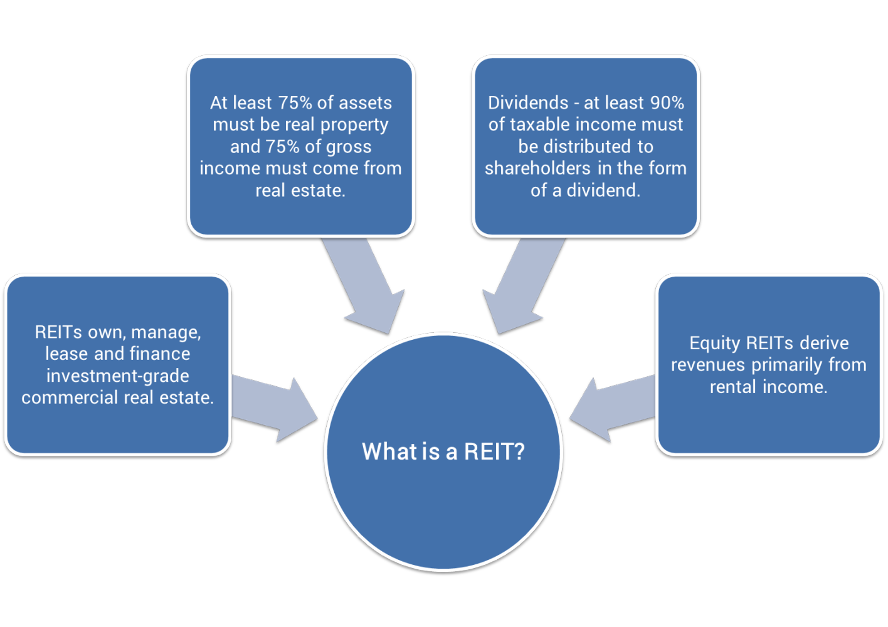

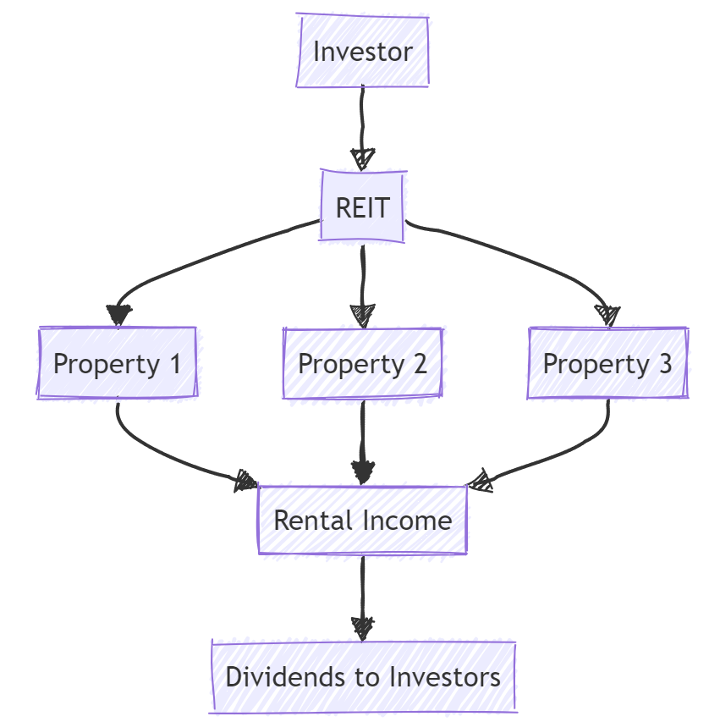

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate.

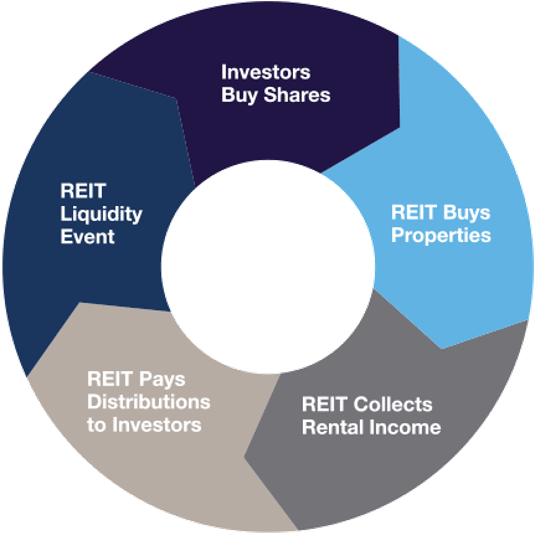

It allows individuals to invest in real estate portfolios the same way they invest in other industries—through the purchase of publicly or privately traded shares, which are considered securities. Publicly traded REITs are available for trading on major security exchanges. This makes them accessible to individual investors. REITs are subject to the Securities Act of 1933, which provides a regulatory framework for these investment vehicles.

REITs were created by Congress in 1960 to democratize real estate investing. The potential benefits of REITs include portfolio diversification and reduced market volatility, allowing investors to benefit from higher yields and a more balanced investment strategy.

They let everyday investors access income-producing properties like apartment complexes, office buildings, apartments, and shopping malls-without buying or managing properties directly.

Types and Structures of REITs

REITs can be classified into three categories:

- Public exchange-traded REITs

- Public non-traded REITs

- Private REITs

Publicly traded REITs often have modest minimum investment requirements, while private REITs demand significantly higher initial investments that can range from $10,000 to $100,000.

Non-listed REITs are registered with the SEC and have some regulatory oversight, unlike private REITs.

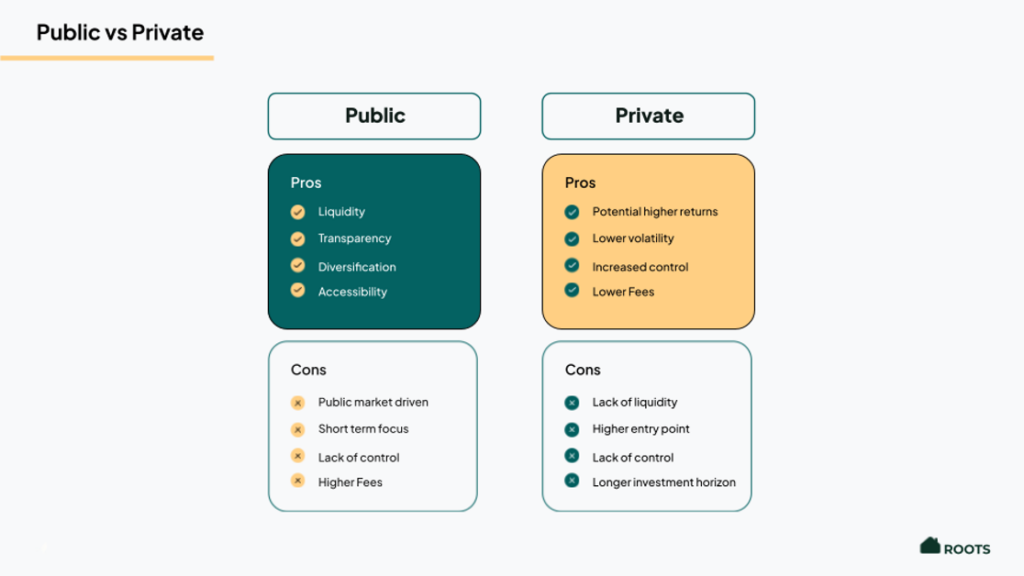

Each has distinct liquidity, transparency, and accessibility profiles.

Public REITs: Highly liquid, allowing investors to easily buy and sell shares on public markets, but exposed to market swings.

Private REITs: Illiquid-but shielded from daily volatility. Private REITs are not listed on major stock exchanges, which makes them less accessible to the general public compared to their publicly traded counterparts.

Private REIT Popularity

Private REITs typically are not traded on public exchanges and are designed primarily for accredited or institutional investors. Private REITs are favored by long-term investors due to their distinct structure and advantages that aren’t typically available in publicly traded alternatives. Private REITs are less affected by stock market volatility, making them appealing to long-term investors looking for consistency in their investment returns. Private REITs often invest in various property types, including apartment complexes, which generate rental income for shareholders.

- Access to off-market properties: Private REITs often invest in institutional-grade real estate that is not accessible through public exchanges. These may include ground-up development projects, opportunistic commercial assets, or strategically located multifamily portfolios acquired through direct relationships. By bypassing public bidding, private REITs can negotiate more favorable purchase terms and identify value-add opportunities early in the investment cycle.

- Reduced market correlation: Because private REIT shares are not traded on the open market, they are largely insulated from the short-term volatility that affects publicly listed securities. Their valuations are typically updated based on periodic appraisals or NAV calculations, rather than reactive investor sentiment. This quality makes private REITs a useful diversification tool for portfolios heavily exposed to traditional equities.

- Stable income potential: Many private REITs are designed to deliver steady, predictable cash flows through long-term leases, essential service properties, or stabilized asset strategies. This makes them appealing to income-oriented investors such as retirees, endowments, and family offices. Furthermore, private REIT managers often have more flexibility in adjusting distributions, managing expenses, and navigating economic cycles, which can contribute to more consistent returns over time.

Together, these characteristics make private REITs especially attractive for patient investors seeking capital preservation, yield, and reduced exposure to public market noise. Only investors who have invested in these trusts can access performance data.

REIT Sector Specialization

Equity REITs own income-generating property. A REIT’s management team plays a crucial role in real estate investing by bringing expertise and diverse skill sets that provide strategic advantages in acquisitions, property management, and tenant relations. REITs focus on specific asset classes or diversify across multiple types of real estate, allowing investors to optimize their portfolios. Accredited investors and institutional investors like pension and hedge funds commit capital to private REITs.

Mortgage REITs hold debt secured by real estate.

Hybrid REITs blend both models.

Risk Management & Redemption

Private REITs often implement redemption programs to manage risk.

These programs protect capital and avoid ‘run-on-the-bank’ behavior during downturns.

Income, Yield & Taxation

By law, REITs must distribute 90% of taxable income.

As pass-through entities, they offer significant tax advantages to shareholders. Understanding the fees and commissions is crucial to know how much of the invested money is allocated to costs. Well-managed private REITs should provide audited financial statements to assure transparency and build trust among potential investors. Additionally, a well-managed private REIT may temporarily close to new investments when it has raised sufficient investor equity to fund new properties, indicating disciplined management.

Performance & Inflation

REITs have historically outpaced traditional equities during inflationary periods.

REITs have also historically outpaced traditional stocks during inflationary periods, providing a reliable investment option.

Their real estate assets make them a natural inflation hedge.

Due Diligence & PPMs

Private REITs require review of Private Placement Memorandums (PPMs). Conducting careful research is essential to thoroughly understand the associated risks, fees, and rewards.

Private placement REITs are specialized real estate investment trusts that are exempt from SEC registration under Regulation D of the Securities Act of 1933. These entities operate with their own rules, known as prospectus exemptions, which dictate who can engage in buying or selling these investment products.

These outline strategy, risk, and lock-up terms.

Investor Suitability

Private REITs are typically available to accredited investors who meet specific net worth thresholds, generally at least $1 million excluding their primary residence.

Brokers facilitate the buying and selling of shares in publicly traded REITs, providing services to both individual and institutional investors. Individual investors can participate in the market by buying and selling shares of publicly traded REITs on exchanges like the NYSE.

These are best suited for long-term holders who are seeking stable income. A financial advisor ensures alignment between REIT strategy and an investor’s investment goals, income, liquidity, and tax planning needs.

Oversight & Regulation

Public REITs follow SEC reporting rules.

Private REITs still file compliance documents, but are exempt from certain regulatory requirements, making them less transparent. Under the Securities Act of 1933, private REITs are allowed to sell securities specifically to accredited and institutional investors.

REITs vs. Direct Ownership

REITs provide real estate exposure without management burden, tenant issues, or maintenance costs.

Various types of institutional investors, such as banks and insurance companies, have the necessary capital and expertise to navigate complex investments in private REITs.

Limited liquidity

Private REITs often have limited or non-existent redemption programs for shares, restricting investors’ ability to liquidate their investments before a liquidation event.

Non-traded REITs, on the other hand, are registered with the SEC and are subject to regulatory oversight, which contrasts with private REITs that operate with less transparency and fewer reporting requirements.

- Higher management fees

- Reduced reporting transparency

Portfolio Construction

A diverse REIT strategy helps to diversify portfolios by including sector variety, liquidity mix, and strategic time horizon. Private REITs are not sold on public securities exchange markets, making them less correlated with market volatility. This includes:

- Sector variety (residential, data, medical)

- Liquidity mix (public + private)

- Strategic time horizon

Final Thoughts

REITs, especially private ones, offer stable yield and long-term value.

Private REIT investing offers stable yield and long-term value but requires proper alignment and research. Proper alignment and research are critical for success.

Consult a Professional

REIT investing is complex. Always consult an advisor, CPA, or attorney before committing capital. Visit crewcampusreit.com for more information and to see next steps.